If you’ve suddenly discovered that your old shares are no longer showing in your demat account, don’t panic. Chances are, your Share Transferred to IEPF (Investor Education and Protection Fund). Let’s be honest – most people don’t even realize their shares have been moved until they check after years. But the good news is, you can claim them back.

In this blog, we’ll explain what “Share Transferred to IEPF” means, why it happens, and most importantly, what documents are required to claim them back easily.

What Does “Share Transferred to IEPF” Mean?

To be frank, when an investor doesn’t claim their dividends or bonuses for seven consecutive years, the government transfers those shares to a special account called the Investor Education and Protection Fund (IEPF).

The aim is to protect unclaimed investments and ensure the money is not misused. But don’t worry – these shares still belong to you, and you can claim them anytime by following a few steps.

Why Are Share Transferred to IEPF?

Be kind to yourself – it’s not always your fault. Many people forget about old investments, change addresses, or lose track of company details.

Common reasons include:

- Not claiming dividends for seven years or more

- Change in address without updating KYC details

- Lost or misplaced physical share certificates

- Name mismatch or death of the shareholder

- Inactive or unlinked PAN or bank account

Documents Required to Claim Share Transferred to IEPF

Here comes the main part – the list of documents you need to recover your Share Transferred to IEPF. Make sure every document is updated and matches your KYC details to avoid rejection.

Essential Documents (For Individual Shareholders):

- Form IEPF-5 (duly filled and submitted online on the MCA portal)

- Acknowledgment copy of the IEPF-5 form

- Original physical share certificate(s) (if available)

- Self-attested copy of PAN Card (of the claimant)

- Self-attested copy of Aadhaar Card (address proof)

- Client Master List (CML) from your depository participant (if demat account exists)

- Cancelled cheque leaf or copy of the first page of passbook (for bank details)

- Copy of dividend warrants (if available)

- Indemnity bond and advance receipt (as per IEPF format)

Additional Documents (In Case of Claiming for Another):

- A document confirming the death of the shareholder (if any)

- Testamentary certificate / Legal will / probate / certificate of legal heirs

- Consent in writing (NOC) from other heirs who are legal (if any)

Just kidding, it seems this list is lengthy, but in fact, the major documents are rather simple to collect. It’s more about being organized and careful while submitting them.

Step-by-Step Process to Claim Share Transferred to IEPF

Here’s a simple way to claim your shares back:

- Go to the IEPF Website (Ministry of Corporate Affairs).

- Download and fill Form IEPF-5 carefully.

- Submit it online and save the acknowledgment.

- Send the physical documents along with the acknowledgment to the Nodal Officer of the respective company.

- Wait for verification – the company checks and sends approval to IEPF.

- IEPF authority reviews and releases your shares or dividend to your demat/bank account.

To be frank, the process takes some time, usually around 2–3 months, but patience pays off when your shares finally return to your name.

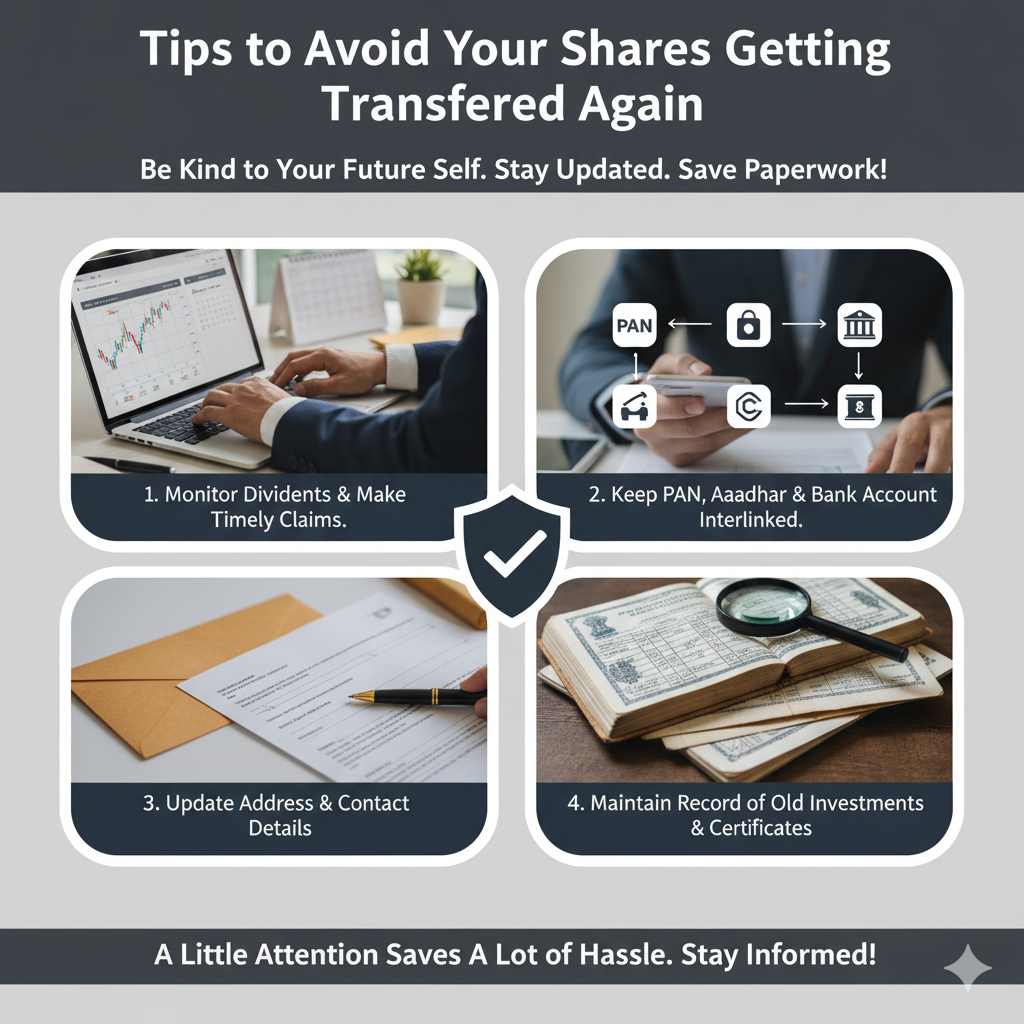

Tips to Avoid Your Shares Getting Transferred Again

Be kind to your future self and stay updated. A little attention can save you a lot of paperwork later!

Quick tips:

- Always monitor the status of your dividends and make timely claims for them

- Always keep your PAN, Aadhaar, and bank account interlinked

- Always inform your company or registrar about any change in your address or contact details

- Maintain a record of old investments and certificates

Facing issues with an old address while claiming your shares? Learn how to fix it in our detailed guide on resolving address change issues.

Want to understand how the transfer of shares process works before you claim your old holdings? Check out our complete guide.

For step-by-step video guidance on IEPF claims and share recovery, visit the official Share Claimers YouTube Channel.

Final Thoughts

Let’s be honest – losing track of shares feels frustrating, but the IEPF system is designed to safeguard your investment, not take it away. Once you gather the right documents and follow the process, you’ll get your Shares Transferred to IEPF back without much hassle.

Remember, your shares still belong to you – all you need is a little patience and proper paperwork.

FAQs

Q1. What happens when Share Transferred to IEPF?

To be frank, your shares move to a government-managed account after seven years of unclaimed dividends, but you can reclaim them anytime.

Q2. How can I check if my shares are transferred to IEPF?

Let’s be honest, just visit the official IEPF website, enter your company name and details – you’ll know right away.

Q3. How long is the process of returning shares by IEPF?

It generally requires document verification and takes approximately 60 to 90 days.

Q4. Can legal heirs claim Share Transferred to IEPF?

Yes, but they’ll need to submit documents like a death certificate, legal heir certificate, and NOC from other heirs.

Q5. What if I don’t have physical share certificates?

Jokes apart, no worries! You can still apply with demat proof or request a duplicate certificate from the company.