If you are someone who believes in long-term investing, then Let’s be honest – holding old physical share certificates is the last thing you want to deal with. Times have changed, brokers have changed, and even the stock market has become faster than ever. That’s exactly why the Dematerialization of Shares has become such a big deal today.

By the way, dematerialization simply means converting paper shares into digital shares. Nothing complicated. But the benefits you get after this conversion are actually huge, especially if you are planning to stay invested for years. In this blog, we will break everything down in easy English, without any heavy financial terms. So let’s get started.

What Exactly Is Dematerialization of Shares?

Dematerialization of Shares is the process where your paper certificates are replaced with electronic entries in your Demat account. Instead of storing physical documents in files or lockers, your shares live in a secure digital format.

In fact, this shift from paper to digital is the biggest upgrade the Indian stock market has seen. It made life easier for both investors and companies.

Why Long-Term Investors Should Care

Let’s be real – long-term investors don’t buy shares for quick profits. They buy them to build wealth. That’s why convenience, security, peace of mind, and long-term tracking become very important. And Dematerialization of Shares gives exactly that.

Here’s why it matters so much.

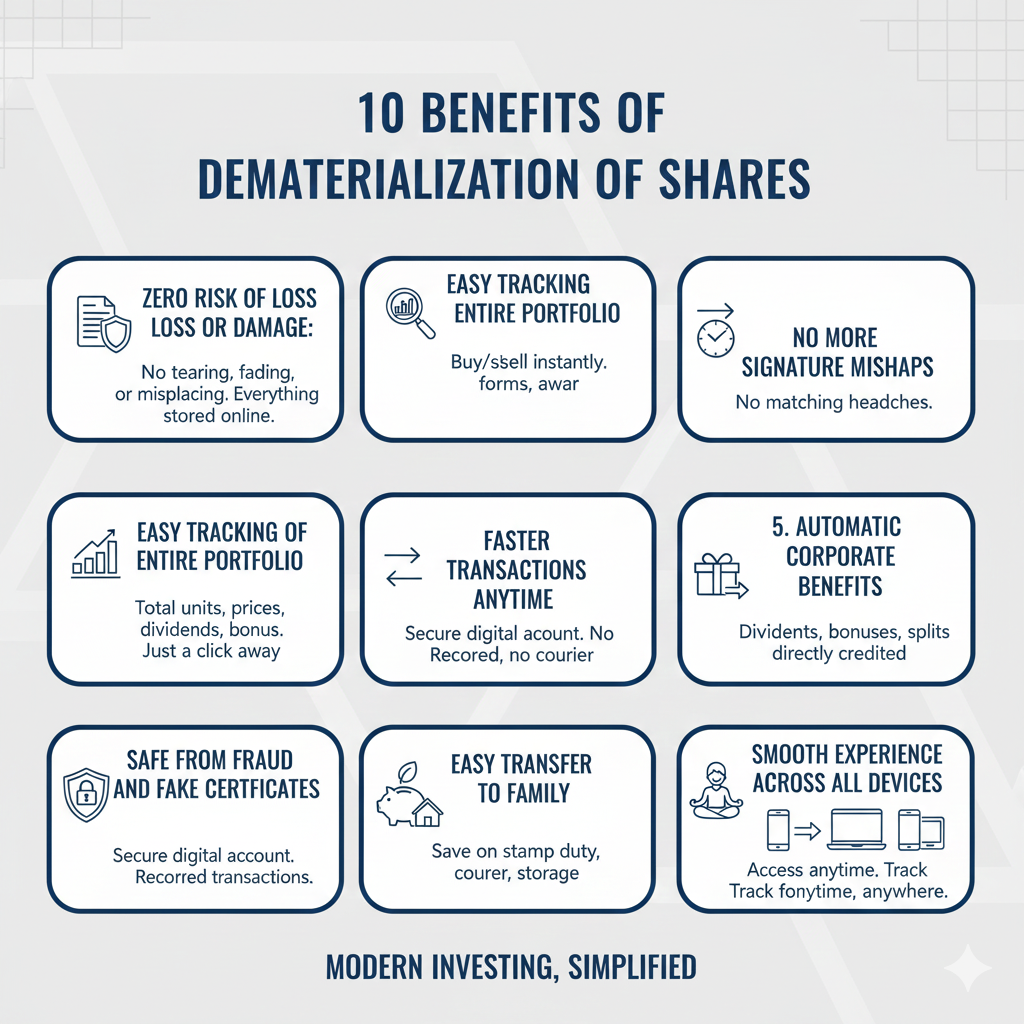

Benefits of Dematerialization of Shares

1. Zero Risk of Loss or Damage

Physical share certificates can:

- Get torn

- Fade with time

- Lose readability

- Get misplaced during shifting

- Get destroyed by moisture

Frankly, nobody has time for this in today’s world. With the Dematerialization of Shares, everything is stored online. No paper, no mess, and no fear of losing your investment.

2. Easy Tracking of Your Entire Portfolio

Long-term investments need regular tracking. With physical shares, tracking is almost impossible.

But after the Dematerialization of Shares, you can check everything in seconds:

- Total units

- Price movements

- Corporate actions

- Dividend history

- Bonus or split updates

Everything is just a click away, which makes long-term planning so much easier.

3. Faster Transactions Anytime

Once your shares are in digital form, you can buy or sell anytime. No need to fill forms or courier certificates.

In fact, demat transactions are instant, which helps long-term investors rebalance their portfolios quickly whenever needed.

4. No More Signature or Name Mishaps

One of the biggest problems with physical certificates is signature mismatch.

People change their signatures unknowingly. Some people sign casually today but differently tomorrow.

The Dematerialization of Shares removes this headache completely. Once your KYC and signature are updated with your broker, there’s no more running behind companies or registrars for matching signatures every time.

5. Automatic Updates for Corporate Benefits

Long-term investors love dividends, bonus shares, and stock splits. But with physical shares, tracking these benefits was painful.

After switching to demat, everything becomes automatic:

- Dividends go directly to your bank

- Bonus shares get added to your demat

- Split shares reflect instantly

- Rights issues become easier to apply

No delays, no paperwork, no stress.

6. Safe from Fraud and Fake Certificates

Let’s be honest – physical certificates can be tampered with. There have been cases of forged certificates in the past.

But the Dematerialization of Shares removes all chances of fraud. Your shares sit safely in your demat account, and every transaction is recorded. No one can steal or duplicate them.

7. Easy Transfer to Your Family in the Future

Long-term investing is also about planning for your family. With demat shares:

- Transmission becomes easy

- Nominee rules are simpler

- No need to handle a pile of old paper

Your family gets your investment smoothly without dealing with complicated paperwork.

8. Low Cost and Zero Maintenance Effort

People think dematerialization is expensive, but honestly, it costs less than maintaining physical shares. You save money on:

- Stamp duty

- Courier charges

- Storage costs

- Transfer paperwork

Plus, DP charges are minimal.

The Dematerialization of Shares basically gives you a modern system with almost no maintenance required.

9. Helps You Think Long-Term Without Stress

Imagine holding physical certificates for 10–20 years. Something or the other will go wrong – fading, damage, name change, loss, or signatures.

Demat removes all these worries.

You invest once, stay invested peacefully, and keep tracking everything from your phone.

That’s a real advantage for long-term investors.

10. Smooth Experience Across All Devices

Whether you use:

- Mobile

- Laptop

- Tablet

You can access your demat account anytime, anywhere.

The Dematerialization of Shares brings convenience that physical shares simply cannot match.

Final Thoughts

If you’re aiming for long-term wealth creation, Dematerialization of Shares is not just a benefit – it’s a necessity. It makes your investment safer, faster, cleaner, and much more manageable.

In fact, it gives you the freedom to focus on building your portfolio instead of worrying about paperwork. The stock market is growing, companies are expanding, and digital investing is now the norm.

So if you still have physical certificates, this is the right time to convert them. Your future self will thank you.

To learn more about the complete process and get expert support, visit our page.

FAQs

1. Is dematerialization compulsory now?

Pretty much yes. Physical shares can’t be traded without dematerialization.

2. Does dematerialization cost a lot?

Not really. It’s cheaper than maintaining physical certificates.

3. How long does the dematerialization process take?

Usually around 15–30 days.

4. Can senior citizens also dematerialize shares easily?

Yes, as long as their documents and signatures match.

5. Are demat shares safer than physical shares?

Absolutely. No theft, no loss, no damage. Much safer.

Follow Share Claimers on Facebook, Instagram, and YouTube for important updates, insights, and news.